Alcohol, cigarettes and mineral oils are subject to excise duty upon production in, or on import to, the EU. OCGs use various modi operandi to avoid excise duties and generate significant profits selling both genuine and counterfeit excise goods at lower prices than their licit equivalents. Excise tax fraud is driven by legislative differences and varying excise tax rates applied by different jurisdictions.

The trafficking of illicit waste typically involves the use of fraudulent documents.

Fuel fraud is a growing phenomenon and typically involves base-oil fraud, also called ‘designer fuel’ fraud and fuel laundering. This type of fraud requires significant expertise, which is usually only available from trained chemists or similar professions.

Excise goods are increasingly offered and bought online.

ABUSE OF DUTY SUSPENSION SCHEMES

The abuse of duty suspension schemes are the main modi operandi used to avoid the payment of excise duties on alcohol products and are also increasingly used to avoid excise duties on tobacco products. These modi operandi involve the exploitation of the EU Excise Movement Control System (EMCS), a computerised system registering the movement of excise goods within the EU, and the T1 procedure, which is applied for excise goods under suspension schemes imported from outside the EU, by falsely declaring the real destination and quantities of excise goods imported into the EU.

How does it work?

In relation to alcohol products, as part of the import process for the EMCS and the T1 procedure, criminals declare a Member State which applies low excise rates as the intended destination of the trafficked goods. Accomplices in the declared country of destination, such as corrupt warehouse employees, confirm receipt of the goods. However, in reality the goods are exported to countries applying high excise rates. The goods appear legitimate as documents certify that any excise obligations due were paid. If the product originates from a country applying high excise rates, the goods often do not leave the country at all and the movement of the goods is purely virtual.

In other cases, traffickers file an application for the transfer of one load and use a duplicate of the transport authorisation to import multiple loads without paying excise duties.

Investment fraud schemes generate huge profits. One investigation revealed estimated profits of up to EUR 3 billion generated by one OCG.

Successful investment fraud schemes typically use various social engineering techniques to operate. Fraud schemes relying on social engineering are particularly hard to counter.

What is social engineering?

Social engineering techniques are a key element to many different types of fraud. Social engineering is the use of deception to manipulate individuals into divulging confidential or personal information that may be used for fraudulent purposes.

OPERATION BATEO

In 2015, law enforcement authorities in the EU launched an investigation into an OCG with ties to Germany, Portugal and Spain. This OCG operated a sophisticated pyramid fraud scheme offering investments into a music sharing platform and other online services. The OCG used various front companies. The investigation was able to identify more than 50,000 victims in 34 countries. Overall, the OCG was able to generate an estimated profit of more than EUR 3 billion.

Criminals orchestrate various investment fraud schemes. The most common schemes encountered in the EU include:

Fraudsters operating Boiler room schemes use cold-calling to contact their victims and pressure them into investing in non-existent or very lowvalue stocks. Fraudsters often use false documents and certificates to present their company and the offered stock as legitimate.

As part of Ponzi schemes, fraudsters attract a group of initial investors with promises of very high returns in a very short time. The fraudster starts to repay the initial investors to attract more victims using funds accrued from additional investors. In reality, the money is not invested and the fraudsters ultimately disappear with the funds. The money is laundered through multiple bank accounts held by various front companies in different jurisdictions.

Pyramid schemes operate on the same model as Ponzi schemes. However, the initial investors are actively involved and are required to recruit new investors in order to get profits.

Mass marketing fraud schemes rely on mass-communication media, including telephones, the internet, mass mailing, television and radio, to contact victims and solicit money or other items of value in one or more jurisdictions.

Fraudsters already rely on social media and instant messaging applications to obtain sensitive information or elicit payments from their victims.

Between May 2014 and May 2015, a UK-based OCG defrauded over EUR 690,000 (GBP 600,000) from pensioners across the country. Posing as police officers, OCG members contacted victims by phone to warn them of the risk of fraud involving their bank. The victims were encouraged to transfer their savings to safekeeping accounts controlled by the fraudsters. 26

Scams relying on phishing or coldcalling can target thousands of victims at once. In one cold-calling case, one telecommunications provider was confronted with 3.6 million attempts against 90,000 victims.

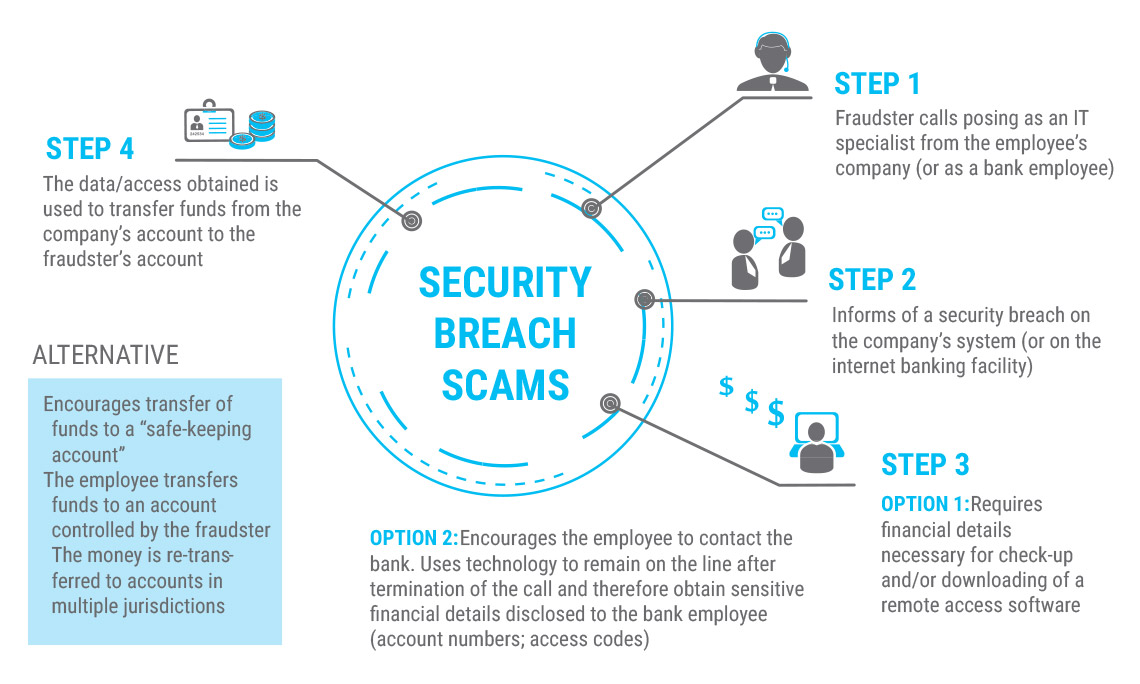

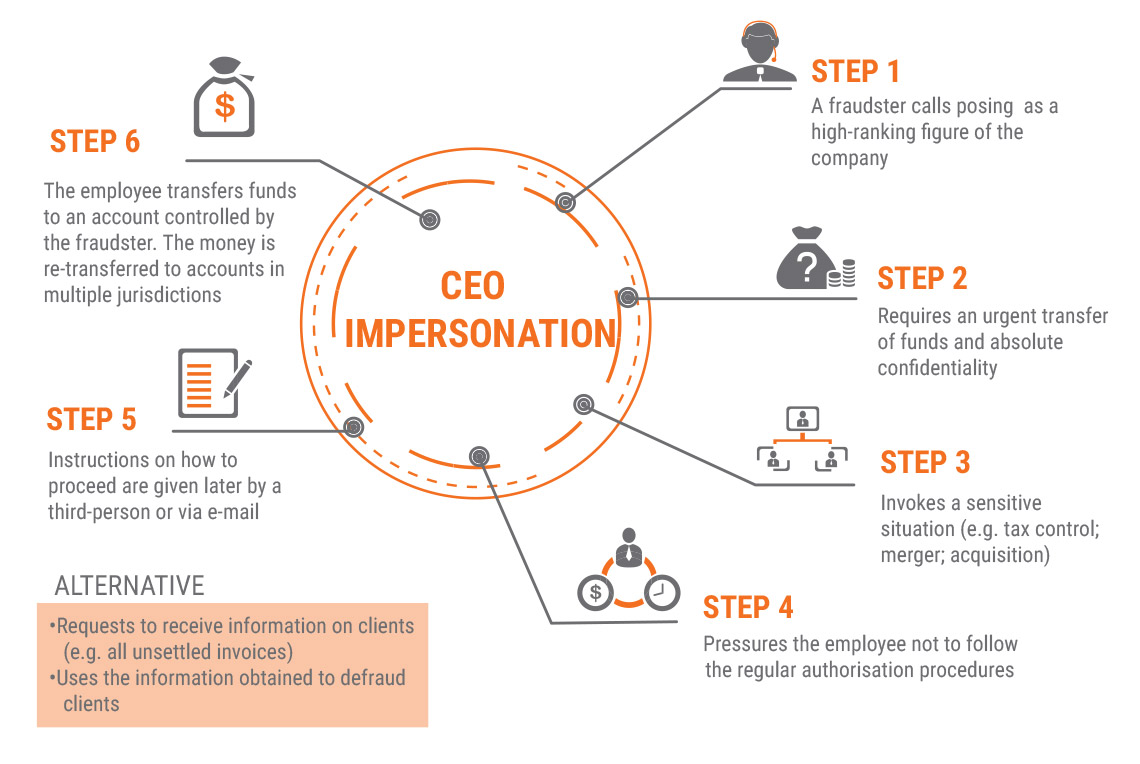

Criminals use fraudulent transfer orders to defraud private and public sector organisations. Typically, the affected organisations are active internationally. This increasingly common type of fraud is also referred to as CEO fraud, wire transfer fraud or business e-mail compromise. Fraudsters heavily rely on social engineering techniques and malware to carry out this type of fraud. OCGs organising CEO fraud schemes targeting organisations based in the EU typically operate remotely from outside the EU.

Typically, stolen funds are transferred through series of accounts in various Member States before reaching destination accounts outside the EU.

UNDERSTANDING FRAUDULENT TRANSFER ORDERS

VAT frauds are highly complex forms of tax fraud relying on the abuse of the VAT rules for cross-border transactions. VAT fraudsters generate multi-billion euro profits by avoiding the payment of VAT or by fraudulently claiming repayments of VAT by national authorities following a chain of transactions. The most common form of VAT fraud is Missing Trader Intra- Community (MTIC) fraud.

MTIC FRAUD

Cross-border transactions within the EU are zero-rated, which means that the payment of the VAT is not due until the goods are sold at their destination. This enables traders to import goods without accounting right away for the VAT. In simple MTIC cases, fraudsters sell the goods, charge the VAT to buyers without remitting the value to the tax authorities.

More complex cases of VAT fraud are typically known as carousel frauds. As part of these fraud schemes goods are imported and sold through a series of companies before being exported again. The exporters of these goods claim and receive the reimbursement of VAT payments that never occurred.

Fraudsters defraud hundreds of millions of euros from private and public insurance providers each year. OCGs are increasingly involved in fraud schemes targeting health care systems.

Benefit fraud schemes cause significant financial losses for all Member States. OCGs and individual fraudsters target social and labour benefit schemes to defraud the state of regular benefit payments. Benefit fraud is strongly linked to THB and migrant smuggling.

OCGs have repeatedly attempted to defraud EU funds by submitting applications for EU grants or tenders. Typically, these applications are based on false declarations such as fraudulent progress reports as well as fraudulent documents such as fake invoices.

In 2015, German law enforcement authorities dismantled a Russian-speaking OCG providing nursing services in order to defraud health care insurance providers.

Procurement procedures are frequently the target of corruption. Criminal groups use bribes to elicit information or directly influence the evaluation of bids in order to win public service tenders in competition with legal businesses. This type of manipulation is particularly notable in the energy, construction, information technology and waste management sectors.

Fraudsters organising loan or credit fraud schemes typically rely on fraudulent documents to obtain bank loans, which are never paid back.